50% Off All

Education Courses

Happy Financial Literacy Month!

Enjoy half off all education courses

with code: LITERACY

Cryptocurrency, a form of digital asset, is designed to work as a medium of exchange. To do this, it uses cryptography to secure and verify transactions as well as control the creation of new units of a particular currency. Essentially, cryptocurrencies are limited entries in a database that no one can change unless specific conditions are fulfilled.

Cryptocurrencies were created as an alternative to traditional currencies. Proponents of cryptocurrency as a viable monetary tool cite the potential benefits of decentralization, anonymity, security, and automation.

Some investors are attracted to cryptocurrency as a diversification strategy because they believe the currency will increase in value; others see lasting value in the blockchain technology behind the currency. Plus, the asset’s performance is not tied to the public markets.

Examples of cryptocurrencies include:

Cryptocurrency is one of the many assets you can hold in a tax-advantaged Equity Trust Company Traditional or Roth IRA. When held in an IRA, cryptocurrency is not subject to short- or long-term capital gains taxes.

Equity Trust’s state-of-the-art platform, combined with customized service from leading providers, offers you a simplified experience. With Equity Trust Company as your cryptocurrency IRA custodian, you benefit from one of the industry’s most advanced platforms, which offers:

Many of the most popular cryptocurrencies are available

Easily invest in minutes online with a few clicks

Online account establishment, buying, and selling

Trades settle the next business day (T+1)

Comprehensive security measures to protect your investments

Backing of an industry-leading self-directed IRA company

In addition to the features listed above, you receive access to leading cryptocurrency providers and an investing experience customized to your comfort level.

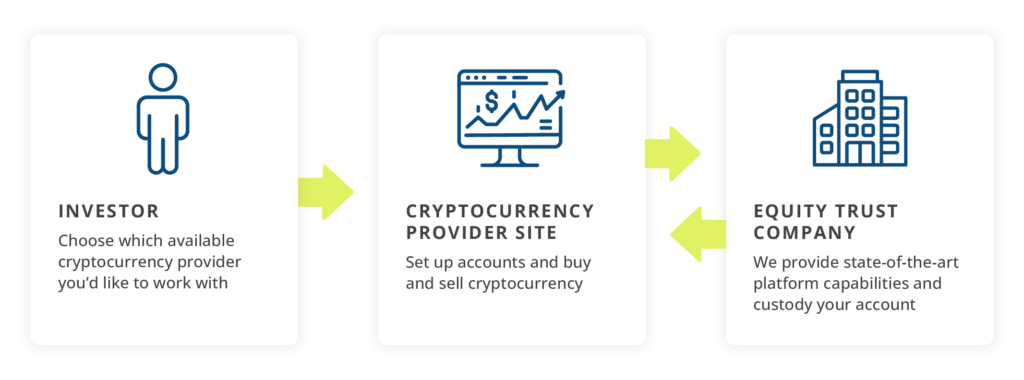

Choose from the companies below to begin the account-open process or start investing through their website. You’ll receive the unbeatable combination of Equity Trust’s innovative cryptocurrency IRA platform and account custody, plus the service and expertise from these providers.

Select a provider that interests you. Learn about their services and offerings. Establish an account or begin investing on the provider’s site.

Self-trading CryptoIRA platform

My Digital Money is a US-based self-trading CryptoIRAplatform that offers military-grade private key security, concierge service, and features to help you make better investment decisions including trigger order, play money account, and others. Visit My Digital Money You are leaving trustetc.com to enter the Coin IRA website (https://www.mydigitalmoney.com/cryptocurrency-investment-guide/). The information and links on the website (“Platform”) you are about to visit are not part of, affiliated with, under the control of, or the responsibility of Equity Trust Company (“Equity Trust”).

First-Class Safety & Security That Sets the Standard

At BitIRA, we firmly believe that Americans should have access to more choices of assets available within their tax-advantaged retirement account. Therefore, one of our primary goals is to help our customers understand how digital currencies can serve as a powerful tool to achieve their unique objectives for saving for the future, while offering a simple, straightforward path to use that tool effectively. Visit BitIRA You are leaving trustetc.com to enter the BitIRA website (https://www.bitira.com/digital-ira/). The information and links on the website (“Platform”) you are about to visit are not part of, affiliated with, under the control of, or the responsibility of Equity Trust Company (“Equity Trust”).

Leader in Customer Experience

Coin IRA is A+ rated and has been accredited by the BBB since December of 2017. As one of the first companies to offer Bitcoin in IRAs, our experts have made it simple for thousands of people to add digital currency to their retirement plans. We know from experience what’s important to you, and our promise is to provide complete transparency, competitive fees, the ultimate in digital asset storage, and fast, easy access to real people who make your satisfaction their top priority. Call us today at 855-431-6612. Visit COIN IRA You are leaving trustetc.com to enter the Coin IRA website (https://coinira.com/cryptocurrency-ira/). The information and links on the website (“Platform”) you are about to visit are not part of, affiliated with, under the control of, or the responsibility of Equity Trust Company (“Equity Trust”).

Invest in Crypto Tax-Free

TaxFreeCrypto.com has everything you need to get started earning tax-advantaged gains in your Traditional IRA or Roth IRA. Our trading platform has no monthly fees, no maintenance fees, no storage fees and low transactional costs. Finally, a platform that protects your assets without breaking your bank. Visit Tax Free Crypto You are leaving trustetc.com to enter the Tax Free Crypto website (https://www.taxfreecrypto.com/). The information and links on the website (“Platform”) you are about to visit are not part of, affiliated with, under the control of, or the responsibility of Equity Trust Company (“Equity Trust”).

Unparalleled Experience and Expertise

BlockMint is brought to you by Lear Capital, an investment company whose expertise and integrity has made it America’s precious metals leader since 1997. With $3 billion in transactions, Lear Capital has securely stored and safeguarded precious metals for its clientele for more than 20 years. This management expertise extends to BlockMint and its retirement offerings in cryptocurrency IRAs. Visit BlockMint You are leaving trustetc.com to enter the BlockMint website (https://www.blockmint.com/). The information and links on the website (“Platform”) you are about to visit are not part of, affiliated with, under the control of, or the responsibility of Equity Trust Company (“Equity Trust”).

Attract more IRA investor business with our innovative cryptocurrency platform and custody services.

Our industry-leading API and white-label solutions make it easy for you and your clients.

You are leaving trustetc.com to enter the ETC Brokerage Services (Member FINRA/SIPC) website (etcbrokerage.com), the registered broker-dealer affiliate of Equity Trust Company. ETC Brokerage Services provides access to brokerage and investment products which ARE NOT FDIC insured. ETC Brokerage does not provide investment advice or recommendations as to any investment. All investments are selected and made solely by self-directed account owners.

Continue